The waves are lining up for a top in the mid-2120s next week just before the final Greek

double-secret probation deadline arrives. With a plausibly-complete wave count and the upper Bollinger Band on the daily SPX within reach, it may be time to get our war face on like old

von Mackensen here.

|

| Anton Ludwig August von Mackensen |

The short-term SPX count seems clear enough. Waves 1 and 3 each took 4-5 days.

|

| SPX 02-18 |

This gives us a sharp drop back to support at 1972 SPX, followed by a kissback rejection of the old 2-4 trendline and a harder fall to 1820.

|

| SPX 02-18 6M |

Today's notes suggest that the Fed will NOT raise rates at the April meeting, bouncing us back up toward SPX 2000. We must keep a very close watch on the yield of the 13-week Treasury bill during this period for clues that the Fed will raise at the June meeting. There's another channel kissback/rejection opportunity around 1985 SPX.

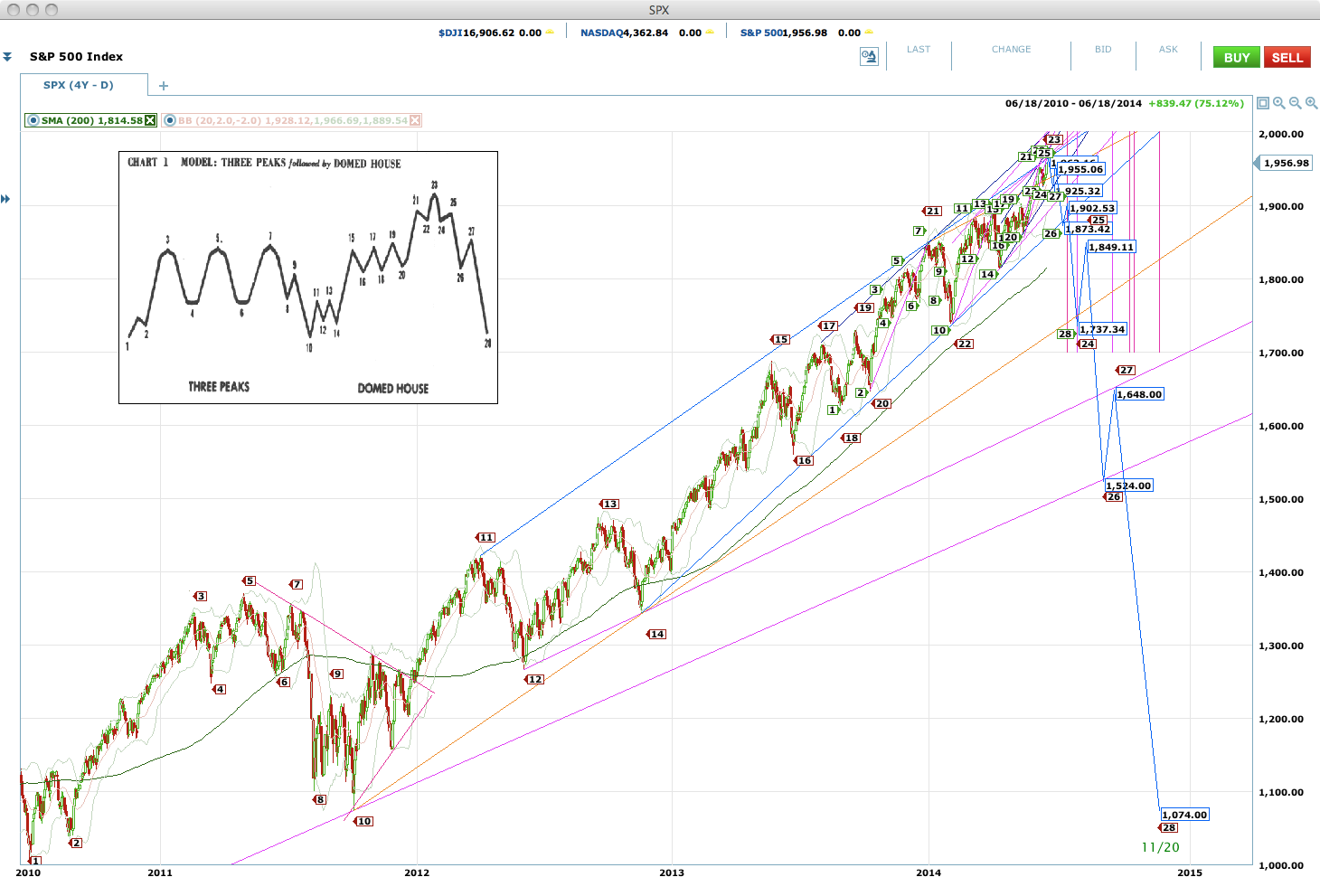

That would drop us to the next level of support around 1530 SPX. A crash in September would finish the 3PDH retrace back below 1100 SPX.

|

| SPX 02-18 10Y |

VIX is setting up well for a low against its lower Bollinger Band and a support trendline that has been running for a while.

|

| VIX 02-18 |