As neighborhoods in a pretty secular city, upper Ballard and Crown Hill in Seattle have a decent share of small churches. Most are old Lutheran churches, from when the neighborhoods were Scandinavian ghettos,

some of which are disappearing. Around the corner from us is the

Crown Hill United Methodist Church, which has an annual book sale in their basement to raise funds for literacy programs.

I confess I don't know exactly what literacy programs are or why they are needed. I started working with my own children at age three, and by five both were active, curious readers. Most parents can't or won't go to the crazy extent that I have, assembling a vast private library, but the public libraries are well-stocked and available for them, gratis. The excellent elementary school my kids attend is public and has a large and very-involved PTA. There are schools in the Seattle system that do not even have PTA organizations -- can you imagine that? -- so maybe these literacy programs are for these people and for their kids. OK, fine. Learn to read.

Last year at this sale, among the romance novels and sun-faded books by Arthur Schlessinger (ecch!), I managed to find a nicer copy of Jim Kunstler's

World Made by Hand than I had, and a neat old 1960s 1st edition of

Medicine for Mountaineering. So I had to go again.

My wife mentioned that this year you could pay $5 to get in to the book sale an hour early. Sure, no problem, it's for a good cause. And then I saw why this was so ... the booksellers were there.

I see them in Value Village once in a while, with their damned scanners. An iPhone app looks up each book by UPC or ISBN or some such, and echoes back its market value. Beep, beep, beep, they work the aisles like grocery stockboys, filling a grocery cart with any book they can find whose quoted value exceeds the thrift store price. Arb the Schlessinger!

These guys don't have physical stores; they're strictly internet. They could care

fuck-all for the book or its author. They're too busy

searching for a yield. I suppose I should appreciate them for the

liquidity they add to the used book market, and maybe even for making possible the search-and-order simplicity of an

abebooks.com. In practice, these guys are annoying as hell.

The Crown Hill Methodists decided to get a piece of the action, so they opened the doors early for those of us willing to pay a little extra. Good for them.

Each had a good-sized box, and as soon as the doors opened, they quickly descended to the church basement for the tables of books (some 6,000+, I think). They worked each row like Mexican apple-pickers, with ruthless efficiency, swipe swipe swipe, one book after another into their boxes. At first it was all instinct, they knew what would provide the vig, but then things slowed down and they went to their infernal iPhone scanners.

If the church is smart, next year they will charge $20 to get in early.

Well, anyway, in the midst of this madness, working slowly and manually I managed to find a few that these jackals missed.

|

| Solzhenitsyn in tha haus dawg |

|

| Michael Lewis and Disney-free Bambi |

I simply added a fresh jacket to each one, and they turned out great. Super.

Last week I found a nice 1945 Heritage Press edition of the Federalist Papers in a new bookstore over on Greenwood Ave. Very nice for six dollars.

|

| Factions for a fraction |

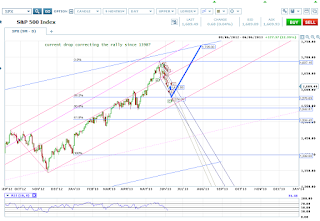

Charts? OK.

We are certainly setup to get the blow-off run to finish the rally from 2009. There's a potential inverse-head-and-shoulders in play, a serious VIX (market-)buy signal, and the McClellan oscillator pointing up, up, up.

|

| SPX 06-07 |

We could have new all-time highs as early as Tuesday, and I would love to see us touch the upper wall of the reflation rally channel this week.

|

| 4Y |

Now Karl just needs to ditch the cul-de sac coffin he's living in and go native in the sticks somewhere. And get some geese!