First, it looks like the

Karl Denninger is in Jim Jones mode again. Getting just a little cult-ish over there at the TickerForum.

We know how this ends. Bottoms-up!

|

| TickerForum keg stand |

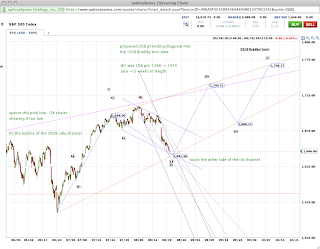

The good news is, I exchanged some email with my old pal

Lunatic_Fringe today, and he not only sent me his current chart and count, but he gave me permission to post it up here. So here it is. Enjoy!

|

| Lunatic_Fringe 8-22 SPX daily |

Luna taught me a very simple and important rule, which he learned from a study of

Glenn Neely -- that

an impulse wave needs to have an unbroken trendline between waves 2 and 4. If the wave 3 obstructs a trendline between these corners, then your count is off.

Sounds easy enough, right? And yet, mainstream Elliottician

Daneric violates it with his count tonight. In fact, if you go back and look at all of his broken and busted counts over the years, his 1-2 1-2 and "leading diagonal" down calls, you will find many instances where his counts break this rule. Which is why they failed.

I'm told it's not Elliott, it's Neely. OK, fine. But I believe it's

correct. And extremely useful.

Lunatic_Fringe is a specialist at fib extensions and identifying wave targets, so I was encouraged when he mentioned SPX 1736 as an area of interest to him. For the "wave 3" of my ending-diagonal, I had suggested 1740. So let's go!

I left all of my trendlines and channel crap I drew on 8/19 on the chart, unchanged. Why? Because the tape seems to have felt out my trendline to 1740 and is using is as support, so far, at any rate.

|

| SPX 08-22 |

Bigger picture,

now with moons! You could subscribe to an

expensive financial newsletter to find out when all of the lunar cycles are ... but I will share them with you

for free!

|

| SPX 08-22 ending-diagonal - with moons! |

IIRC, the 2007 top was an ending-diagonal as well, but on a shorter timeline. Let's have a look at her.

|

| SPX 2007 market top |

Looks like a bearish ending-diagonal wedge, followed by that elusive

leading-diagonal Daneric has called for the last 10 bounces on the chart, until we made new highs. OK, I'll leave him alone.

Now let's stretch the 2007 top and overlay it onto the current and projected tape:

|

| 2007 top morphed onto 2013 tape with October top |

I guess I could have stretched this several ways -- like lining up waves 0 and 2, and letting the rest fall into place. That would put the top well beyond October 8, so we'll keep an eye out for that.

I'll play with this some more, and see if it's at all useful. If anything, it suggests that wave (iv) in the series might be very shallow, and not make it down to the lower trendline of the E-D.

Thanks again for the chart, Luna.