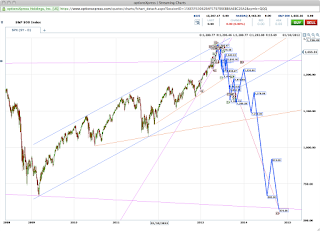

We finally crossed the channel, even pierced the other side before closing at its bottom. This is a bit of a warning, because the dip buyers were tardy on this drop. On my count, this was a sharp wave 4, giving us 1705 as a target if wave (v) is similar to the 56.61 pt wave (i).

May 30, five sessions from now and in the vicinity of the GDP number and other data, would be lovely.

|

| SPX 05-22 |

|

| 9M |

|

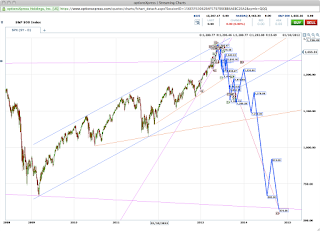

| 5Y |

11 comments:

if we go downside tomorrow, is that going to change your count? what could make 1687 to be your top?

If that was it, then you could count the last leg since 4/18 as an ending-diagonal wedge. It's still not satisfying that we came all this way and did not fully cross the big channel since the 2009 lows.

Are you serious about 574?

With NO SIGN of QE ending, what could possibly be the catalyst for a 1000 pt drop (other than an alien invasion)?

Germany leaving the Euro. Japan in ruins.

Futures looking rough tonight so far, new lows.

/ES off another 17.50 now ... nasty.

Dont worry! Big POMO day tomorrow...uncle Benny to the rescue!

It is hard to imagine now how they could dig out of this hole. McHugh has an interesting take on this. He's been calling for a sharp pullback and a later, final blow-off top.

Yeah, 1705 is blown to bits for now. It still remains to be seen whether yesterday was October 11, 2007, or if we will still manage to put in a higher high.

Bryan Franco has been posting about a 3% dip, followed by a final high.

3% off 1687 is ... 1636 ... and we just hit 1635 this morning.

Bryan? YT?

and do you expect spx will go up after touching 1636 ?

I sure hope so! Whether in that final 5th wave, or a wave 2 retrace.

Look at how weak UVXY is this morning.

On market-death, shouldn't it be putting in 25%+ daily gains?

Hi - Christian, right, just based on looking at the sequence of every instance of 3-5% and 5%+ corrections in the Dow since 1896, but keep in mind, i am using closing prices. I suppose if THE TOP can be put in under your latest wave count, a move down to the vicinity of your Wave 2 (maybe just above at 1600-ish) followed by a new high would suffice. I would answer your question with a question: if said correction goes that deep, how quickly would wave 5have to unfold into your 1705 target before the time proportionality starts to look iffy? I am just trying to marry your 1705 target with the 3% + required selloff by my work, AND see if it can all happen in the latest sequence of waves from the mid-april low.

Post a Comment