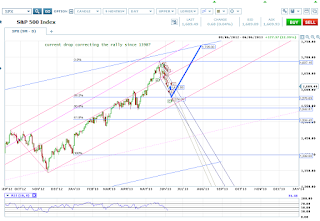

Scoping out the current channels, I think the current drop will end mid-next week around SPX 1574, with one last strong summer rally to follow. The rally could end at the July 31 FOMC, or even stretch through August if it's some sort of tricky terminal pattern like a big E-D.

Zooming out, it starts to look like this move may actually correct the giant move up since SPX 1398, instead of the sharp rally that began April 18th.

The important thing will be that it touches the other side of the giant channel since the 2009 lows. That will mark the completion of the reflation rally and the start of the next true bear market.

Edit: OMG is the McClellan in oversold territory. Wow.

|

| SPX 06-06 a.m. |

|

| 9M |

|

| 5Y |

2 comments:

A final higher high to the low sp'1700s would really mess with the minds of many.

--

Certainly late July/August would make for a great key cycle top.

CG - I am with you on both the 1574 and 1700s. By my work, we need a new high per what i'd written ad nauseum about, and the good news is, it will be an eligible "Top top", as we've now had a sequence of 3 back-to-back 3% + corrections based on closing prices.

Post a Comment